Home / Health Insurance / Articles / Individual Health Insurance / Top Reasons Why Individual Health Insurance Applications Get Rejected

Top Reasons Why Individual Health Insurance Applications Get Rejected

Roocha KanadeDec 10, 2025

Share Post

Health insurance is one of the best ways to take care of your medical treatments, as it acts as a reliable financial backup. However, at times, your application may get rejected due to some avoidable mistakes. A common mistake is not being honest and truthful when buying a policy. This can lead to rejection and you might end up without financial security when needed the most.

To avoid rejection, it is a good idea to know in advance what exactly insurance companies look for when you apply for health insurance. In this article, we have shed light on what are the common reasons for rejection and how you can avoid them.

Contents

- Common Reasons for Individual Health Insurance Rejection

- How Medical History Impacts Individual Health Insurance Approval

- Financial and Policy-Related Reasons for Health Insurance Rejection

- Situations That Can Lead to Claim Rejection Later

- How to Avoid Individual Health Insurance Rejection

- What to Do If Your Health Insurance Application gets Rejected?

- Conclusion

- FAQs on Individual Health Insurance Application Rejection

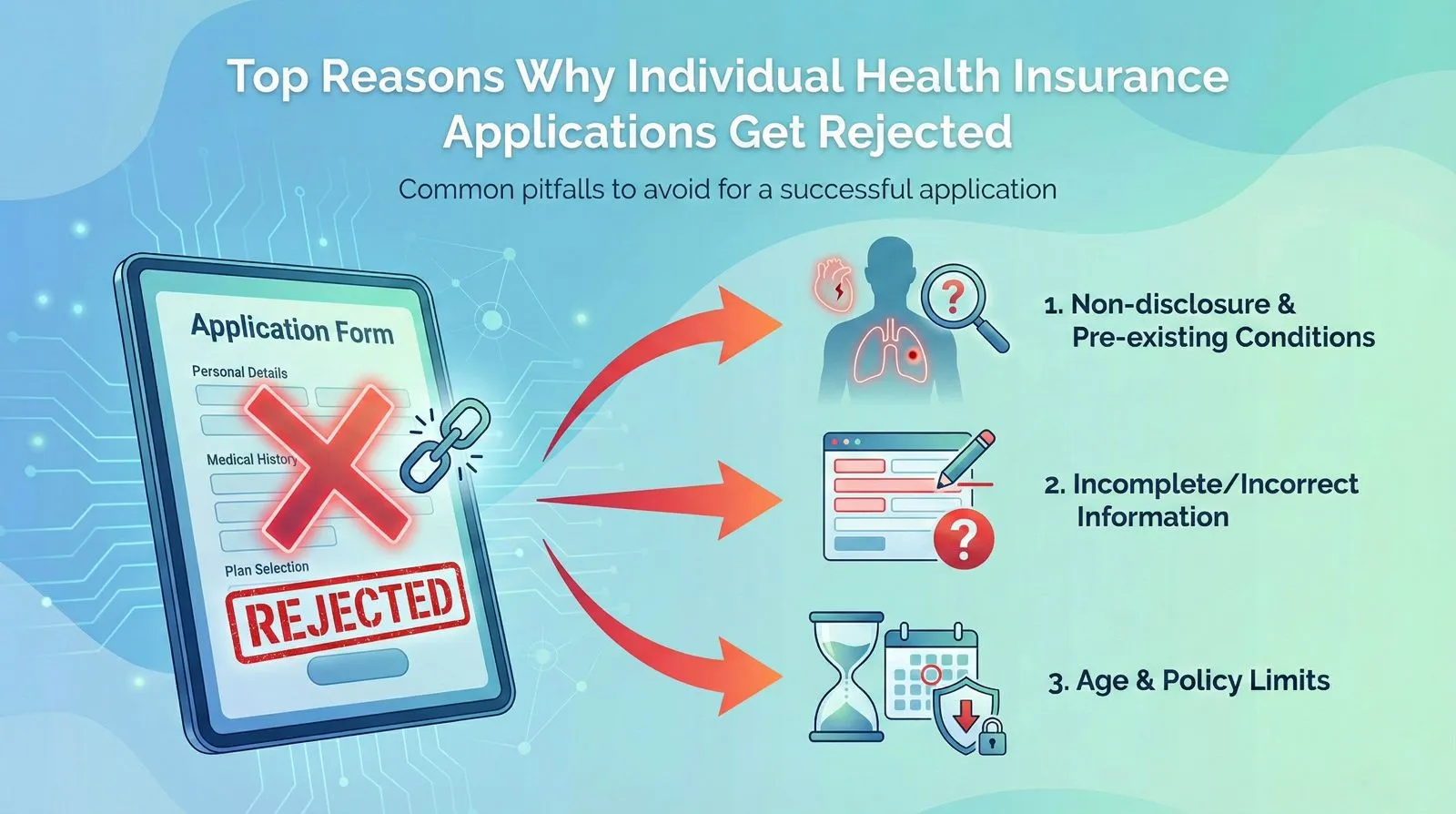

Common Reasons for Individual Health Insurance Rejection

Here is a list of common reasons for rejection of individual health insurance policy.

Not disclosing a pre-existing disease

Not disclosing a pre-existing disease or a medical condition is one of the most common reasons why a health insurance application may be rejected by an insurance company. Your medical history is an important factor that the insurer will consider while reviewing your application. Thus, it negatively affects your chances of approval if you are not being honest about the medical history.

Be honest and transparent about even the most minor conditions. This will help with faster approvals while buying the plan and reduce the chances of claim rejection in the future.

Incorrect details in the application form

Sometimes you might accidentally enter incorrect information while filling the application form. For example, spelling mistakes in your name, incorrect date of birth, old phone number which is not in use anymore, etc.

Since the insurance company will conduct a thorough check on this information through a process called KYC (Know Your Customer), these details will be verified. If the details that you have entered are found to be incorrect, your application will be rejected.

Failed Medical Tests or High-Risk Health Results

Some people may have serious medical conditions that need frequent treatment. These would be high-risk for the insurance companies as they would claim frequently. Insurers thus ask you to go through a medical check-up as a part of the application process.

The results of these tests would determine if you need to pay a higher premium, get limited coverage, buy more riders, or if the application will be rejected. The solution is to try and buy a health plan as early in life as possible.

Unstable Income or Mismatch in Payment Details

While not very common, an application may be rejected if the income you declare doesn’t match your documents or if your payment details don’t pass verification. Insurers check these to ensure you can maintain the policy long-term. Keeping your financial information and KYC details updated helps avoid these issues.

How Medical History Impacts Individual Health Insurance Approval

Here are a few reasons how your medical history impacts the application.

Insurers check your medical history first because it helps them understand your overall health risk.

Having conditions like diabetes, high blood pressure, thyroid issues, or a past surgery does not automatically lead to rejection.

Most of the time, insurers simply adjust the policy terms, such as adding a waiting period, increasing the premium slightly, or adding a co-pay.

Being honest about your health makes the approval process easier and avoids claim issues later.

Keeping your medical reports, prescriptions, and recent test results ready helps speed up verification and reduce delays.

Financial and Policy-Related Reasons for Health Insurance Rejection

Medical History is not the only thing that an insurance company checks while reviewing your health insurance application. They also check your financial health. Following is a list of common financial or policy-related reasons that can lead to a rejection.

Frequently missed premium payments: Frequently missed premium payments lead to a lapse in the health insurance policy. If your policy was lapsed multiple times in the past, then your new application may get rejected.

Wrong PAN or Aadhaar details: Providing wrong information related to the PAN or Aadhaar card would lead to incorrect identification. As this is how fraudsters operate, it might lead to scrutiny on you too and eventually cause a rejection.

Incorrect or outdated KYC information: Something as simple as an old address, a spelling error in your name, or an expired ID can stop the verification process. If these mismatches aren’t fixed, the insurer may reject your application.

Payment or bank details that don’t go through: Sometimes the application fails because the provided bank details are wrong, the card gets declined, or the auto-debit request is not approved. These small issues can still lead to rejection.

To avoid these problems, keep your documents updated, pay premiums on time, and double-check all personal and payment details before submitting your application. A clean policy history makes approval much easier and faster.

Situations That Can Lead to Claim Rejection Later

Here are some situations which can lead to claim rejection.

1. Health issues not disclosed earlier

If you were already taking medicines for something like high blood pressure but didn’t mention it while buying the policy, the insurer may reject your claim when they discover this during verification. Non-disclosure is one of the most common reasons for claim denial.

2. Claim raised during the waiting period

If you get hospitalised for a condition that is still within its waiting period, the insurer may not accept the claim. This usually happens with pre-existing illnesses or treatments that have fixed waiting times, and many people are unaware of these timelines.

3. Mismatch in hospital documents

Even small errors can cause problems. For example, if your hospital bill shows one admission date but your claim form has another, the insurer may hold or reject the claim until the details are corrected. Accurate paperwork is key to smooth claim approval.

Reviewing your policy every year, updating medical information, and keeping documents organised ensures stress-free claims when you need them.

How to Avoid Individual Health Insurance Rejection

Here are some tips to avoid individual health insurance policy rejection.

Share correct details and be honest

Being transparent is the easiest way to avoid application rejection. Share everything, whether it’s an old surgery, a long-term condition, or occasional medication. When insurers have a clear picture of your health, they can assess your application fairly and offer the right coverage.

Buy Health Insurance Early

Applying at a younger age usually means fewer health risks and fewer chances of rejection. When you buy early, you not only get smoother approval but also enjoy lower premiums and more flexible coverage options.

Maintain Medical Reports and Test Results

If you’re undergoing treatment or have had recent tests, keep those reports ready. Submitting updated medical documents helps insurers verify your information quickly and speeds up the approval process.

Choose the Right Sum Insured and Coverage

Choosing a very high sum insured without matching income or medical reasons may lead insurers to reassess your risk. Pick a coverage amount that fits your lifestyle, health needs, and financial situation to avoid unnecessary red flags.

What to Do If Your Health Insurance Application gets Rejected?

Here are the things you can do in case your application gets rejected.

Understand the Reason Behind the Rejection

If not mentioned already, then contact the insurance company and try to understand the exact reason behind the rejection. IRDAI also states that the insurance company should give a clear reason for rejecting an application.

Recheck for Errors in the Application

There could be some errors like spelling mistakes, incorrect dates, or missing documents in the application. You would also need to check for outdated documents. Update them at the earliest and correct any errors. then you can resubmit the application.

Explore Other Options

Since different insurance companies have different underwriting rules, one insurance may reject an application but another could accept the same.

Seek Expert Guidance

If you are applying for health insurance for the first time, it is advisable to get the right guidance from an insurance expert. They will ensure that the application does not get rejected due to avoidable mistakes in the application. They can also guide you to buy the right coverage.

Conclusion

Most individual health insurance rejections happen due to missing information, incomplete documents, or skipped medical disclosures. Being honest about your health, choosing the right coverage, and applying early can significantly improve your approval chances. When you stay prepared, your individual health insurance application is processed faster, smoother, and without any surprises.

FAQs on Individual Health Insurance Application Rejection

Here are common questions on individual health insurance application rejection.

Why was my individual health insurance application rejected?

Your individual health insurance application might have been rejected due to undisclosed medical conditions, incorrect information, unstable medical results, or mismatched KYC and payment details.

Can I reapply after my application is rejected?

Yes, you can reapply. Just make sure you correct the issues from your previous application and provide complete information.

Does having a pre-existing disease mean rejection?

No, in most cases, insurers offer policies with waiting periods, higher premiums, or special conditions instead of rejecting the application.

How can I prevent rejection when applying for health insurance?

To avoid rejection when applying for health insurance, you must share correct information, keep the documents updated, adopt healthy habits, etc.

Does my age affect the chances of application rejection?

Yes, age can make a difference. Older applicants often undergo more medical tests, and if the results indicate higher health risks, it can impact approval. When you apply earlier in life, the process is usually much smoother and your chances of getting approved are higher.

Does having past claim rejections affect my new application?

No, past claim rejections don’t impact new applications as long as they weren’t due to fraud or intentional non-disclosure. Clean documentation helps.

Recent

Articles

Family Health Insurance vs Individual Health Insurance: Key Differences

Roocha Kanade Dec 10, 2025

Why Should Every Woman Have an Individual Health Insurance Plan?

Roocha Kanade Dec 10, 2025

Advantages of Individual Health Insurance for People Aged 20 to 35

Roocha Kanade Dec 10, 2025

Top Reasons Why Individual Health Insurance Applications Get Rejected

Roocha Kanade Dec 10, 2025

How Pre-existing Diseases Impact Your Individual Health Insurance Premiums

Roocha Kanade Dec 10, 2025

All Articles

Want to post any comments?

Discover our diverse range of Health Insurance Plans tailored to meet your specific requirements🏥

✅ 100% Room Rent Covered* ✅ Zero deductions at claims ✅ 7100+ Cashless Hospitals

Check health insurance